skip to main |

skip to sidebar

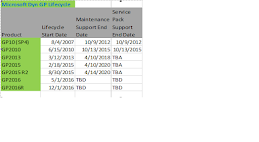

Depending on the version of Microsoft Dynamics GP a

company is running, the steps to edit the 1099 information is done in various

ways. We conducted a 20 minute webcast for our current clients, but thought it

would be worth sharing it with all current Microsoft Dynamics GP customers in

this 1099 Processing Tips &

Tricks video.

If you are in need of a Microsoft Dynamics Partner who

stays informed of the latest changes in your software, contact Collins Computing today! We are

experts in Microsoft Dynamics software and are available to support, train, and

help you get the most out of your current investment. We are available when

your users need assistance – thru phone or email – and will jump on a

connection with you immediately to solve your issue or question!

Find

out why agricultural farmers

and accounting firms to telecommunication companies and water theme parks use

Collins Computing to assist them in streamlining their accounting systems

to work for them! Don’t stay stagnant, get moving to rapidly respond to your

customer needs!

1. Microsoft is still on target to release 2013 Round 2 Tax Update by Friday, January 11th.

2. People are asking......"How can we run payroll? And on the check registers, the employee social

security does not exactly match the employer social security. It is off by

pennies (both at 6.2 rate)."

Example Below:

This is OK. It is due to how we have "rounding" code in the employee side, but not the employer. This will be changed to make sure both amounts match when the rate is the same.

This will be in the January Hotfix due out at the end of week 1/21/2013 for GP2010 and GP2013.

If you have any questions, please contact support@collinscomputing.com or call (888) 391-6690.

The Federal

2013 Tax Tables have released - http://www.irs.gov/pub/irs-pdf/n1036.pdf.

The

Round 2 2013 US Payroll Tax Update is scheduled to release mid-week next week

(table only). We will let you know when it is officially released.

Below is a list of changes to be included in Round 2:

- Federal (Single, Married & Nonresident Alien filing

status) (Social Security and Medicare changed in round 1)

- Colorado

- Connecticut

- Georgia

- Hawaii

- Illinois

- Maine

- Oklahoma

- Oregon

- Puerto Rico

- Rhode Island

If you have any questions,

please contact support@collinscomputing.com

or call (888) 391-6690.

Happy New

Year!

Below

is information from Microsoft on the most recent changes:

- The Employee FICA rate will go up to 6.2 ...this was not part of the fiscal

disaster this weekend; this is the rate currently on our 2013 tax tables

we released on Friday 12/21/2012. If you have already installed

Round 1 then there is nothing more to do until the next release as stated

in #2 below.

- Microsoft

is waiting for the final publication to be released for Federal and then

they will release the Round 2 Payroll Tax Update with all Federal and

State changes currently pending, so far only table changes.

- Regardless

of whether you are on the below list of states, you will need to have the

Round 1 update because of the FICA changes.

States

Included:

- California

- Kansas

- Kentucky

- Maryland

- Minnesota

- Nebraska

- New York

- North Dakota

- Yonkers

- FICA Employee Social Security limit $113,700

- FICA Employee Social Security Rate 6.2

- 2013 New Employee Medicare Taxes on High Earners (after

$200,000) extra .9 (2.35)

This

update will be on the automatic server/download too...so be CAREFUL as you

continue to do updates, you can always revert back and Microsoft tax update

pages have the 2012 tax tables on it too.

Once

you install the update, the new date is 1/1/2013.

2012 tax tables MUST be loaded when you CREATE the year end wage

file for the FICA SS and FICA MED to be correct and not cause

validation errors for customers.

Contact support@collinscomputing.com if

you run into any issues.

If you

haven't already done Year End, CLICK HERE for Year End Procedures.

**NOTES**

There are

more state changes but Microsoft has pushed those to Round 2 which is due to

release around 1/21/2013. This will have code changes.

If you have any questions or need help, please

contact support@collinscomputing.com or call (888) 391-6690.