Below is an outline of what Microsoft has going on in the coming

months in regards to Payroll Tax Updates...

US Payroll Tax Update - Round 6

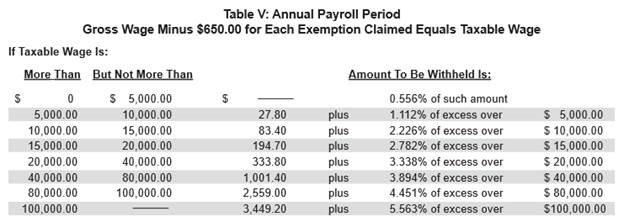

The state of Connecticut

released a tax table change effective 8/1 or by 8/31.

This is a tax table change only and is scheduled for release the 1st

week of September.

US Payroll Year End Update

Scheduled to release in November 2015. The changes are

pending.

Next Product to Release

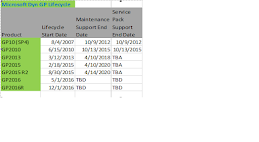

The next product to release will be Microsoft Dynamics GP 2016

and is scheduled for around Convergence time.

Microsoft will continue to support GP 2013, GP 2015 and GP 2016

for tax updates, patches, etc. GP 2010 will no longer receive

updates after October 2015.