On Friday, July 31st,

the state of Ohio

released revised tax tables effective 8/1/2015.

The new tables take into consideration the income tax rate

reductions that went into effect when The Budget Bill was signed into law on

June 30, 2015. The tables reflect a 3.1% reduction in the withholding

rates previously in effect for 2014; the new tables are to be used for the

remainder of calendar year 2015 and in future years.

The new withholding

tables are posted on the Employer Withholding Tax Web page, which can be

accessed by clicking here. The tables

include the percentage method for calculating withholding as well as daily,

weekly, biweekly, semimonthly and monthly tables.

The new date after you

install is 8/7/2015.

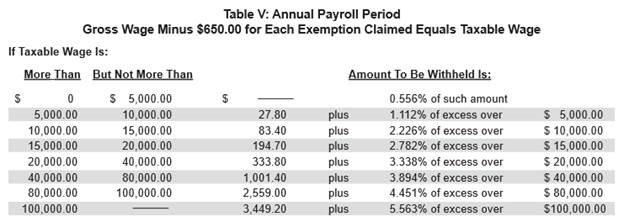

Below are the new rates:

Download Links:

If you have any questions or need help updating,

please call Collins Support at (888) 391-6690 or email support@collinscomputing.com.